Poll Results

Kuala Lumpur | 30 January

The UCSI Poll Research Centre recently conducted poll research on youngsters in Malaysia on their current indebtedness.

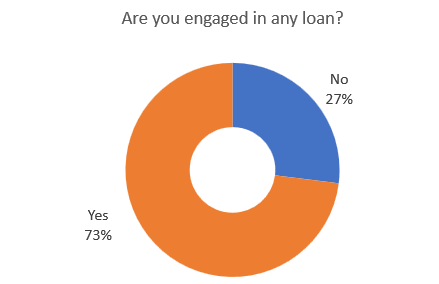

Out of the 1,077 youngsters in the study, 73% have taken loans. This indicates that about three-quarters of Malaysian youngsters do not have sufficient capital for financial commitments. Although the number of borrowers among the youngsters is worrying, 83% of them could pay their loans on time.

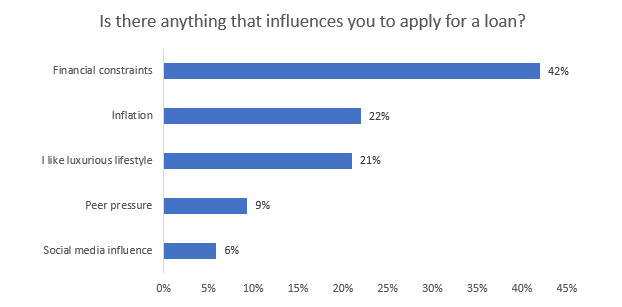

The main reasons for taking the loans are financial constraint (42%), inflation (22%) and luxurious lifestyle (21%).

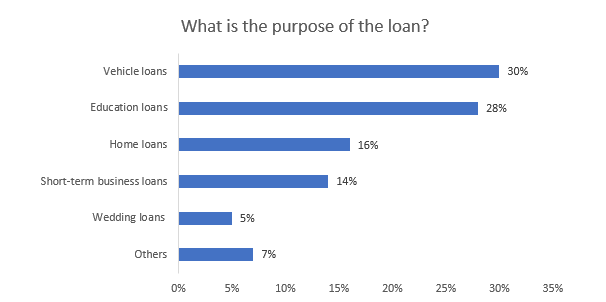

Other than that, the poll questions the purpose of the loans made by the respondents. Results shows that 30% are vehicle loans, 28% are education loans and 16% are home loans. According to the results, vehicle and education are the main factors causing youngsters to apply for a loan. It is alarming to have vehicle loans on top of the pyramid as according to the Insolvency Department Malaysia, vehicle loans (14.39%) has been the second causal factor of bankruptcy rate after personal loan (42.24%) in the year 2022.

On loan defaulting, 73% of the youngsters are aware of the consequences. This indicates that Malaysian youngsters do not apply for loans blindly.

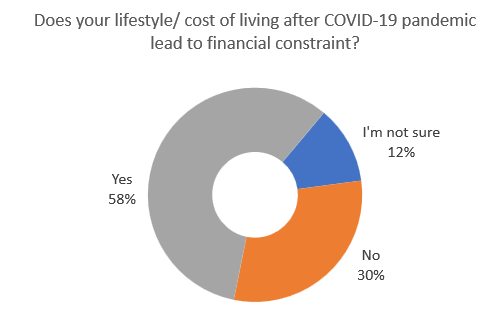

On the effect of COVID-19 on their lifestyle or cost of living, 58% of the respondents stated that their financial status has been affected. The results of 58% respondents affected by COVID-19 may due to unemployment, unstable income and the increase in commitments as the pandemic has affected a lot of companies and individuals in Malaysia.

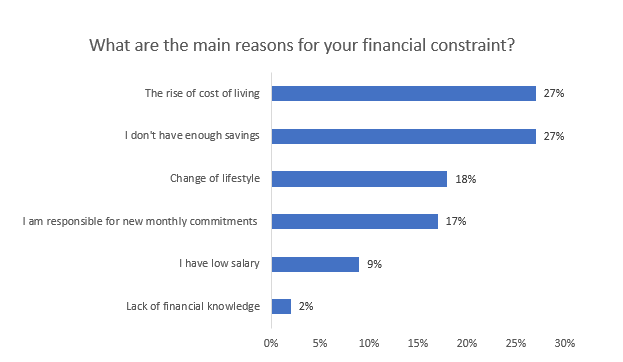

Lastly, the poll seeks insights on the main reason of their financial constraint. According to the findings, the growth in the cost of living and insufficient savings (27%) are the primary causes of financial constraint, while a change in lifestyle is the third primary cause of financial constraint. The change in lifestyle may have been necessary to some of the youngsters because a lot of things has changed during the pandemic. One of the examples are university students; the transition from physical classes to online classes requires each student to have their own laptop and home Wi-Fi for them to join online classes which indirectly affected their daily financial well-being.

“Based on the finding of this poll research, it is understandable that most youngsters are in debt as they do not have enough savings to begin a new chapter of their life which later causes them to apply for loans. Based on the outcome of this research, it could be concluded that majority of the youngsters are having greater financial constraints due to the COVID-19 strikes. With the current financial crisis period, inflation has also contributed to the number of borrowers among youngsters in Malaysia. In addition, there are always a mismatch between the demand and supply which lead to continuous problem.” said Dr Hassanudin bin Mohd Thas Thaker, the Head of Research and Postgraduate Studies, Faculty of Business and Management, UCSI University.

About UCSI Poll Research Centre The UCSI Poll Research Centre (UCSI-PRC) is a public opinion research company owned by the UCSI Group. Its main objective is to utilise original and scientific research methodologies to investigate and analyse public opinions and attitudes.